Medicare Advantage Plans: What Seniors Should Know

A Medicare Advantage Plan is available for people who have a Medicare health plan and want to expand their coverage to the next level. Medicare Advantage, also referred to as “Part C” or “MA Plans,” is a commercial health insurance plan approved by Medicare that provides supplementary health coverage. Additionally, Part C premiums might be as low as zero dollars per month.¹

You have more control over your healthcare with Medicare Advantage. It’s possible to get coverage for everything from hospitalization to prescription medicines under Part C. In this article, we’ll go over everything seniors need to know about Medicare Advantage Plans.

What Are the Coverage of Medicare Advantage Plans?

Medicare Advantage Plans (Part C) include Part A and B coverage. It is a Medicare-approved private health insurance alternative.² Medicare will pay a predetermined monthly amount to the firm that provides your Part C plan, allowing seniors to get additional coverage not given on conventional plans.

At a minimum, Original Medicare (Part A and Part B) are covered by Part C. To get a Medicare Advantage Plan, seniors must first enroll in Medicare Parts A and B.

Part A coverage includes the following:

- Inpatient treatment

- Hospice services

- Professional nursing care³

Part B coverage includes the following:

- Clinical investigation

- Psychological health

- Long-lasting medical equipment

- Prescription medications for outpatients

- Other outpatient services such as ambulance transportation⁴

The insurance plan has integrated Part A, Part B, and additional services to create Part C plans. After enrolling in Parts A and B, you’ll select a Medicare Advantage Plan that’s best for you and register with a private insurance provider.

While Original Medicare does not cover the majority of prescription drugs, you can add this vital coverage to your Medicare Advantage Plan by combining prescription drug coverage (Part D). Vision, hearing, dental, and wellness programs are all included in this plan, which Original Medicare does not cover.

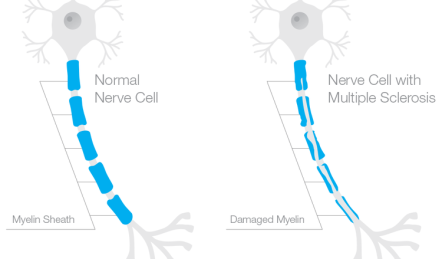

It’s standard for all Medicare Advantage plans to cover emergency and urgently required care. Insurance policies can be tailored to accommodate the needs of policyholders with chronological illnesses, which can include benefits designed to address those conditions.

Among the additional benefits covered by your Part C policy are the following:

- Transportation for medical appointments

- Over-the-counter medications

- Adult daycare services

- Wheelchair ramps and shower grips for your home

- Meal service

It’s critical to keep in mind that Medicare Advantage Plan costs vary. You may be required to pay for services that your plan determines are not medically essential, but you also have the opportunity to dispute that decision.

What Are the Costs of Medicare Advantage Plans?

The cost you pay out of pocket is determined by several factors. Some plans require a monthly fee, while others don’t need one at all. Some insurance policies may cover all or a portion of your Part B premium. Look into this before making your final decision on a Part C insurance plan.

Due to the federal government’s collaboration with private insurers to handle your Medicare Advantage Plan, they have established relationships with a network of physicians and hospitals. It is how insurers pass along premium savings to their consumers, which means that visiting doctors and receiving services not covered by your private insurance will cost you extra.

Out-of-pocket expenses will vary from plan to plan. For covered care, you may have to pay a deductible and a copayment, or you may require a referral to a specialist. Additionally, you’ll be required to pay the Part B premium.

Finally, the type of healthcare you require will influence your overall costs. You may pay more if you choose to include additional services such as transportation or prescription medication. However, if you do your homework, you may be able to get a Medicare Advantage Plan with a $0 payment. It’s easy to locate a plan that’s both reasonable and provides the coverage you need by comparing several MA policies online.

Explore Medicare Advantage Plans on the Internet

If you’re seeking additional coverage that your current health plan does not provide, you may want to consider Medicare Advantage Plans. Those with long-term health conditions can tailor their health insurance policies to provide coverage for the medical treatments they require.

A Medicare Advantage Plan is only available if you have both Part A and Part B. You can go online to explore plans and learn more about the rules to get started. You can save money on healthcare by signing up for a private insurance plan, which has broad access to physicians and associates to choose from.

Before making a final decision, do some homework. This will ensure that you receive the maximum level of coverage at the lowest possible price.

References:

¹What are $0 Monthly Premium Medicare Advantage Plans

²Medicare Advantage Plans cover all Medicare services

³Medicare, What Part A covers

⁴Medicare, What Part B covers