How to Pay Less for Insulin?

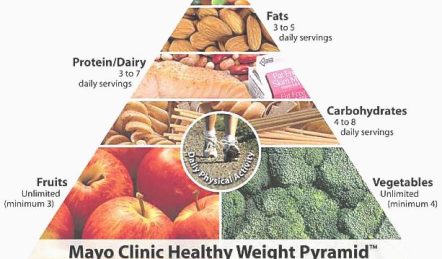

Diabetes is a debilitating condition that can be managed by exercise, a healthy diet, and the proper use of insulin and other drugs to regulate blood sugar. Diabetes patients are at an elevated risk of significant health problems such as early death, loss of sight, heart failure, stroke, kidney failure, and toe, foot, or leg amputation.

The cost of health care for someone with diabetes is more than twice as high as the cost for someone without diabetes. Nonetheless, there are ways to cut back on some of the expenditures associated with diabetes care.

Insulin, which regulates blood sugar, is used by more than 7 million people in the United States, according to the American Diabetes Association. However, the price of this life-saving medication has risen dramatically in the previous five years.

Pharmaceutical Assistance Programs

Pharmaceutical assistance programs are services provided by specific organizations to aid people in affording their prescriptions. Almost every company that makes diabetic drugs or insulin has its program for patients.

These initiatives are intended for individuals who lack health insurance and have a low income. To be considered, you must meet those criteria. Specific programs accept applications from Medicare Part D members.

Diabetes is a costly disease. Fortunately, diabetes patients can save money on their prescriptions by availing of drug savings plans. The first step is to conduct an online search to check what plans are currently available. Diabetic patients can save money on their prescriptions by signing up for these programs.

Novo Nordisk

Novo Nordisk has a good savings plan if you’re seeking one. Customers who meet the requirements could get their medication for as little as $10 for a 30-day supply. When it comes to diabetes management, you have many options for drugs and payment methods.

A NovoCare representative is available to answer your questions over the phone at specific times of the day. It’s also possible to fill out a form online and get an answer within minutes. Ensure that you have your prescription insurance card’s information available.

You can also speak with a diabetes health coach for free to discuss your objectives, get the guidance, and answer any queries you may have about diabetes care. You can reach them through phone, text message, or email.

Reimbursement is not available to those enrolled in a federal or state health care program that covers prescription drugs.

Lilly USA

Lilly USA is another economical option for purchasing diabetic medicine. Regardless of the dosage that has been prescribed, you could pay as little as $25 a month for the medication. Assistance is also available for persons who have lost their work or access to medical coverage and require financial aid to pay for medical care.

Approximately 92% of medications cost between $0 and $30 per month, with the remaining expenditure averaging $239 per month. In the end, your insurance coverage will determine how much you pay out of pocket. The best way is to call their hotline to get specialized help with a Lilly USA plan.

If you receive your card through email, there is no need to activate it first. However, doctor-issued cards must be activated online.

Get in touch with a Lilly USA customer service agent right away to learn more about the services they provide.

Medicare Enrollees Have Several Savings Options

If people with diabetes are registered in specific medicare health plans, they can save a lot of money on their prescriptions. As long as you have the proper medical plan, you can get coverage for everything from medication to testing to educational programs.

It would be best if you had Medicare Part D to get drug coverage. This coverage helps older people pay for insulin injections, insulin inhalers, and other drugs to regulate blood sugar. Additionally, it can assist with the cost of injection supplies such as syringes, needles, and gauze.

Medicare Part B provides extra coverage for diabetics. Some AARP Medicare plans include coverage for the following:

- Medical nutrition therapy

- Hemoglobin A1C tests

- Diabetes self-management training

- Foot exams and treatment for nerve damage related to diabetes

- Therapeutic shoes or inserts, and;

- Eye test for glaucoma

Additionally, Medicare Part B may cover consumables for blood glucose monitoring, insulin pumps, and insulin. Typically, Medicare will cover about 80% of the cost. After the annual deductible is satisfied, you are responsible for 20% of the approved amount. The price you pay for items covered by Part D is determined by your individual plan, which varies by customer.

Diabetes management can be difficult and costly. Juggling is a difficult task. Do not hesitate to contact a healthcare expert or organization if you require assistance.

Look for Medication Saving Plans Online

In the current economic climate, it is becoming increasingly difficult for people with diabetes to cover the costs of their medications and other essential medical care. According to the American Diabetes Association, the overall cost of diagnosed diabetes has grown from $245 billion to $327 billion in just five years. ¹

You should be able to obtain medication without having to worry about your financial situation. That is why it is worthwhile to investigate prescription savings options.

If you’re considering starting a new prescription in conjunction with a particular savings plan, see your physician first. They can discuss potential adverse effects and confirm that the medication will adequately meet your diabetes needs.

References:

¹The Cost of Diabetes